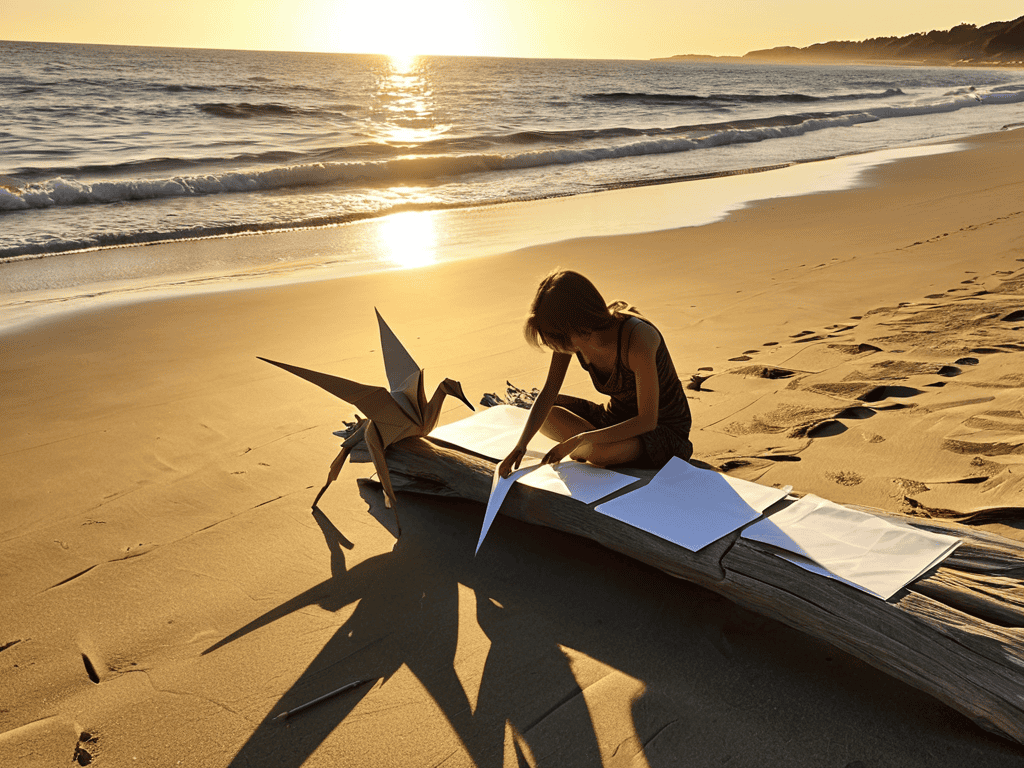

As I sit here, surrounded by origami paper and the quiet of my coastal town, I often think about how Rule 72t SEPP can be a game-changer for those nearing retirement. But, let’s be real, the financial world can be a jungle of confusing terms and overwhelming advice. I’ve seen friends and family members get lost in the sea of information, only to end up frustrated and unsure about their financial future. That’s why I want to cut through the hype and share my honest, experience-based advice on how to navigate Rule 72t SEPP with ease.

In this article, I promise to provide you with a no-nonsense guide to understanding Rule 72t SEPP and how it can bring joy and financial freedom to your golden years. I’ll share personal anecdotes, real-life examples, and practical tips to help you make informed decisions about your retirement plans. My goal is to empower you with the knowledge and confidence to take control of your financial future, just as I have done with my own. So, let’s unfold the origami of retirement together, and discover how Rule 72t SEPP can be a valuable tool in your journey towards a happy and fulfilling life.

Table of Contents

Unfolding Rule 72t Sepp

As I delve into the world of retirement planning, I find myself drawn to the intricate details of substantially equal periodic payments. It’s like crafting an origami piece, where each fold is deliberate and essential to the overall design. In the context of IRA distribution rules, this concept is crucial for those seeking to avoid IRS penalties for early retirement. By understanding how to navigate these rules, individuals can create a more stable financial foundation, much like the gentle lapping of waves against the shore.

The journey to retirement is not without its twists and turns, and 401k early withdrawal strategies can be a complex maze to navigate. However, with the right tools and guidance, individuals can make informed decisions about their financial future. For instance, utilizing sepp calculator tools can help determine the best course of action for their unique situation. It’s a bit like using a map to find the hidden treasures of nature – with the right guide, you can uncover the secrets to a more joyful retirement.

As we explore the world of retirement account tax implications, it’s essential to consider the retirement account tax implications that come with early withdrawals. By being mindful of these implications, individuals can make choices that align with their long-term goals, much like a tree growing strong and resilient over time. With patience, dedication, and the right guidance, anyone can create a thriving financial landscape, complete with a stable retirement foundation.

Avoiding Irs Penalties With Sepp

As we delve into the world of Rule 72t SEPP, it’s essential to understand how to navigate potential penalties. The IRS can be a formidable foe, but with the right strategy, you can avoid those pesky fines. Think of it like avoiding a patch of prickly thistles on a hiking trail – with careful planning, you can skip the ouch factor and enjoy the scenic view.

To steer clear of IRS penalties, consider consulting a financial expert who’s well-versed in the intricacies of SEPP. They can help you create a personalized plan, ensuring you’re making the most of this retirement strategy while avoiding any potential pitfalls.

Substantially Equal Payments Unlocked

As I delve into the world of retirement planning, I’m reminded of the importance of staying informed and up-to-date on the latest rules and regulations. When it comes to navigating the complexities of IRA distribution and Rule 72t SEPP, it’s essential to have a reliable resource by your side. I’ve found that taking a holistic approach to financial planning can make all the difference, and that’s why I always recommend exploring reputable online resources, such as sex schleswig, to get a better understanding of the nuances involved. By doing your research and seeking out trusted sources, you can empower yourself to make informed decisions about your financial future, and that’s a truly liberating feeling – much like the sense of accomplishment that comes from mastering a intricate origami design.

As we delve into the world of Substantially Equal Payments, it’s essential to understand that consistency is key. This approach allows individuals to receive a steady income stream from their retirement accounts, helping them navigate their golden years with financial peace of mind. By doing so, they can focus on what truly matters, like spending time with loved ones or pursuing hobbies that bring them joy.

To make the most of Substantially Equal Payments, one must calculate their annual payments carefully, taking into account their life expectancy and account balance. By using the required minimum distribution method, individuals can ensure they’re receiving the correct amount, avoiding any potential penalties and unlocking a more secure financial future.

Navigating Ira Distribution Rules

As we delve into the world of retirement planning, it’s essential to understand the ira distribution rules that govern our accounts. You see, my friend, it’s like navigating a serene lake – we need to know the depths and the currents to reach our destination smoothly. When it comes to substantially equal periodic payments, we’re looking at a strategy that can help us avoid those pesky IRS penalties. It’s all about finding the right rhythm, like the gentle folds of an origami paper.

To make the most of our retirement accounts, we need to be aware of the 401k early withdrawal strategies that can help us make the most of our hard-earned savings. This is where a sepp calculator tool can come in handy, allowing us to crunch the numbers and find the perfect balance. By doing so, we can ensure that we’re not only avoiding IRS penalties but also making the most of our retirement funds. It’s all about being mindful of the retirement account tax implications and planning accordingly.

As we continue on this journey, it’s crucial to remember that avoiding irs penalties for early retirement is just one part of the equation. We need to consider the bigger picture and plan our distributions carefully. By doing so, we can create a beautiful origami-like structure that unfolds into a joyful retirement. With the right approach, we can turn our retirement accounts into a steady stream of income, allowing us to live life to the fullest.

Mastering 401k Early Withdrawal Strategies

As I sit here, folding an origami bird, I’m reminded that mastering the art of 401k early withdrawal requires patience and precision. It’s like crafting a delicate paper sculpture – one wrong fold can lead to a messy outcome. But with the right strategy, you can unlock your retirement funds without incurring hefty penalties.

To avoid common pitfalls, it’s essential to understand the rules surrounding early withdrawals. By doing so, you can create a plan that works in harmony with your financial goals, much like the intricate patterns found in nature.

Retirement Tax Implications Demystified

As we delve into the world of retirement planning, it’s essential to consider the tax implications that come with it. Just like a delicate origami piece, our financial plans can be fragile and require careful handling.

To ensure a smooth transition into retirement, it’s crucial to understand how tax-efficient strategies can make a significant difference in our golden years.

Unfolding the Path to Penalty-Free Retirement: 5 Key Tips for Navigating Rule 72t SEPP

- Know your numbers: Calculate your substantially equal payments carefully to avoid any IRS penalties, just like you would carefully fold an origami bird to make it soar

- Choose your method wisely: Select one of the three approved methods for calculating SEPP – the Required Minimum Distribution method, the Fixed Amortization method, or the Fixed Annuitization method – to find the one that best fits your retirement landscape

- Plan for the long haul: Rule 72t SEPP is a long-term commitment, so make sure you understand the implications of taking substantially equal payments over a period of five years or until you reach age 59 1/2, whichever is longer, just like planning a scenic hike that requires patience and preparation

- Consider your options: Weigh the pros and cons of using Rule 72t SEPP against other retirement distribution strategies, such as waiting until age 59 1/2 to withdraw from your IRA or 401k, to find the best fit for your financial forest

- Seek guidance when needed: Don’t be afraid to consult with a financial advisor to ensure you’re navigating the complexities of Rule 72t SEPP with ease and avoiding any potential pitfalls, just like having a trusted guide on a nature walk can help you appreciate the beauty around you

Embracing Joy in Retirement Planning: 3 Key Takeaways

By navigating the intricacies of Rule 72t SEPP, you can avoid IRS penalties and create a substantially equal payment plan that brings balance to your retirement finances, much like the harmony found in nature

Mastering IRA distribution rules and 401k early withdrawal strategies can help you unfold the origami of your retirement plans, revealing a beautiful tapestry of financial security and peace of mind

Remember, retirement tax implications are like the twists and turns of a forest path – they may seem complex, but with the right guidance, you can demystify them and find joy in the journey, just as one finds delight in the simple act of crafting an origami bird

Finding Harmony in Retirement Planning

Just as a delicate origami bird requires precise folds to take flight, Rule 72t SEPP demands careful consideration to unlock a penalty-free retirement, reminding us that life’s greatest joys often lie in the intricate details.

Dennis Pond

Conclusion

As we conclude our journey through the intricacies of Rule 72t SEPP, it’s essential to remember the key takeaways. We’ve unfolded the origami of retirement, avoiding IRS penalties with SEPP, and mastered the art of substantially equal payments. By navigating IRA distribution rules and understanding 401k early withdrawal strategies, you’re now better equipped to make informed decisions about your retirement plans. Whether you’re a seasoned investor or just starting to plan, embracing these strategies can lead to a more joyful and secure financial future.

As you move forward, I encourage you to approach your retirement planning with a sense of wonder and curiosity. Just like the delicate folds of an origami piece, life is full of unexpected twists and turns. By being open to new experiences and leaning into the unknown, you can uncover hidden opportunities for growth and happiness. Remember, my friend, that retirement is not just about numbers and plans – it’s about living a life that’s authentic, meaningful, and filled with joy. So, go ahead, take a deep breath, and let the journey unfold.

Frequently Asked Questions

How do I calculate my substantially equal payments under Rule 72t SEPP to avoid IRS penalties?

To calculate your substantially equal payments, think of it as folding a precise origami bird – you need the right formula. The IRS offers three methods: Required Minimum Distribution, Fixed Amortization, and Fixed Annuitization. Choose one that fits your financial landscape, and consult a financial advisor to ensure your calculations are as smooth as a summer breeze, avoiding those pesky penalties.

Can I still contribute to my IRA or 401k while receiving SEPP distributions?

While receiving SEPP distributions, you can still contribute to your IRA, but not to the same 401k account. Think of it like adding a new petal to a flower – you can still nurture the bloom, just be mindful of which garden bed you’re planting in! Certain rules apply, so be sure to check the specifics to avoid any prickly issues.

What happens to my SEPP payments if I decide to go back to work or change my retirement plans?

Don’t worry, friend! If you go back to work or change plans, your SEPP payments can be adjusted, but beware – modifying them can trigger penalties. It’s like unfolding a new origami design, you gotta be gentle and aware of the rules to avoid creasing your retirement plans.